Przelewy z rachunku VAT, jakie można robić?

Check a UK VAT number. Use this service to check: if a UK VAT registration number is valid. the name and address of the business the number is registered to. This service is also available in.

Numer VAT Co to jest? 123Faktury

Your VAT number, also known as a VAT Registration Number (VRN), identifies you as a business. Nobody else has the same combination of numbers and letters to ensure that your VAT returns and information are not mixed up with another company. The goal of your VRN is to: Identify you as a VAT-registered business.

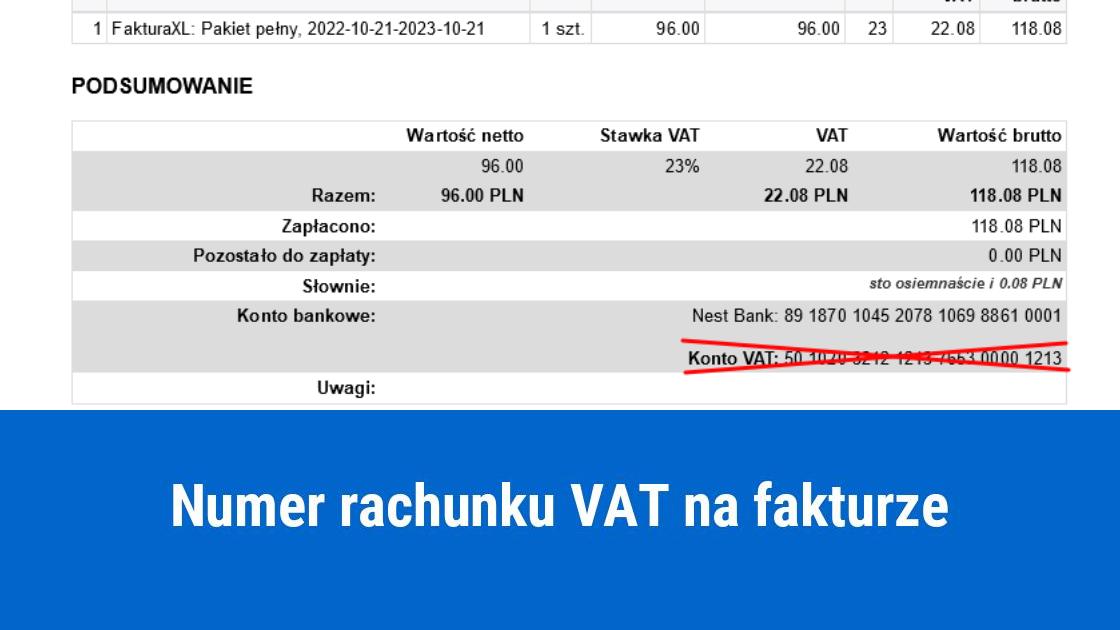

Stawka VAT na fakturze

A value-added tax, or VAT, is a tax on products or services when sellers add value to them. In some countries, VAT is called goods and services tax, or GST. Similar to a sales tax or excise tax.

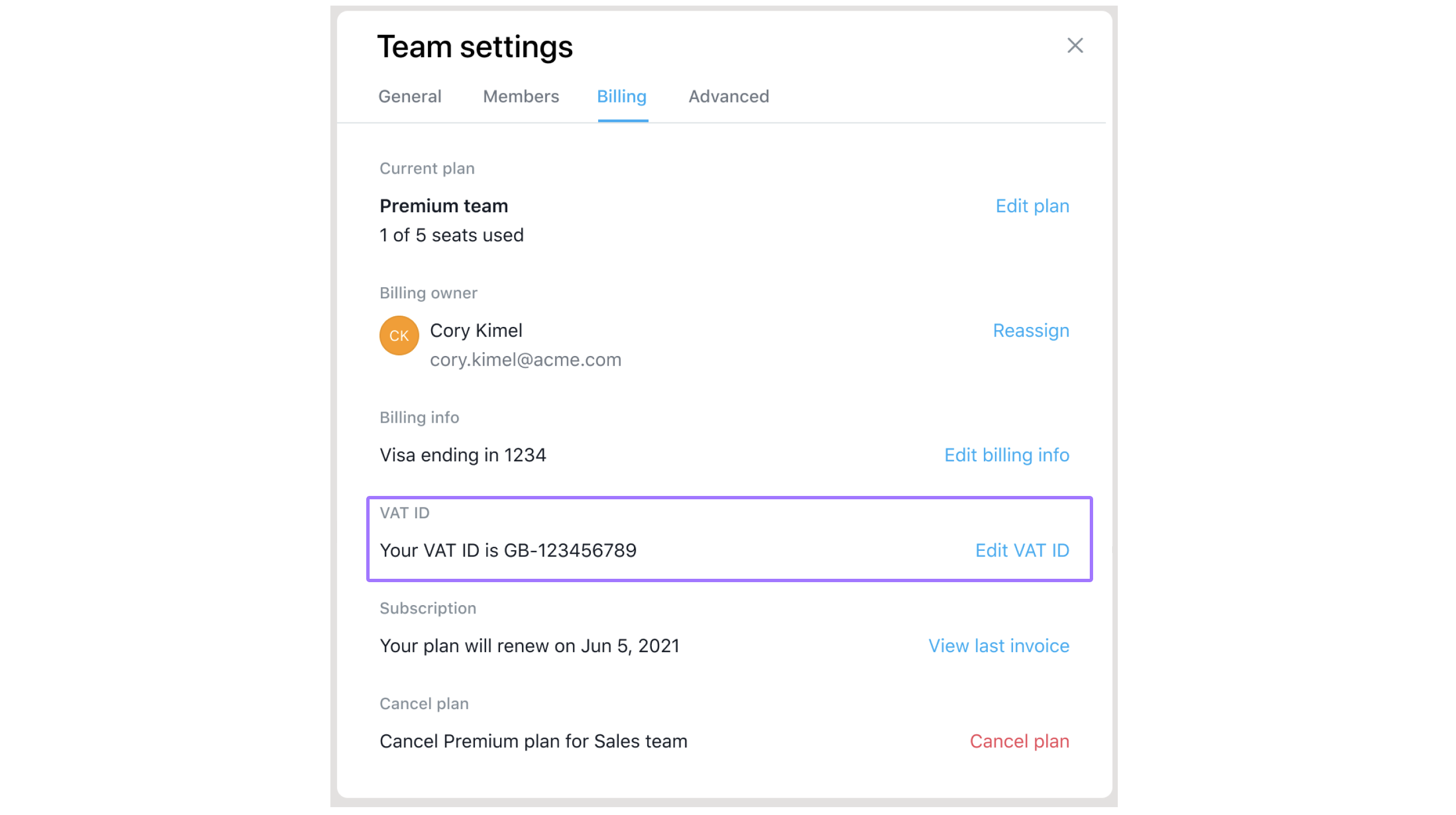

VAT • Asana Product Guide

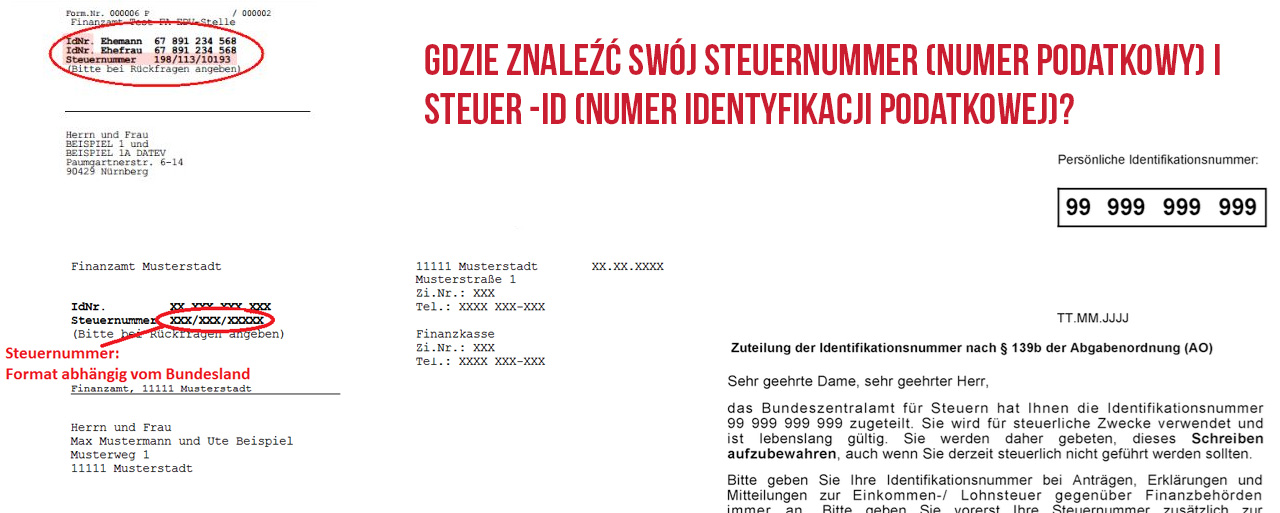

The first two numbers are the country code. Here is a list of all the countries and their corresponding code. United Kingdom: 0. Luxembourg: 352. France: 33. VAT is a value-added tax, usually in the form of a sales tax or similar levy. It is collected by the government of a country and applied at each stage of.

Numer VAT UE jak wystawić fakturę dla podatnika, który go nie ma?

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest payments, and profits as well as materials. As with other consumption taxes, including goods and services tax (GST) or retail sales taxes, consumers pay value-added tax.

Grocerjy Shop and order your daily grocery & supermarket Items online

The importance of VAT numbers. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that.

Rejestracja brytyjskiej firmy w Polsce w celu otrzymania numeru VAT

Numer VAT jest identyfikatorem podatkowym używanym w celu identyfikacji podatników VAT, czyli podatku od wartości dodanej. Jest to unikalny numer przypisany firmie lub osobie prowadzącej działalność gospodarczą, który jest używany do celów rozliczeniowych związanych z VAT. Spis treści ukryj. 1 Definicja i cel numeru VAT.

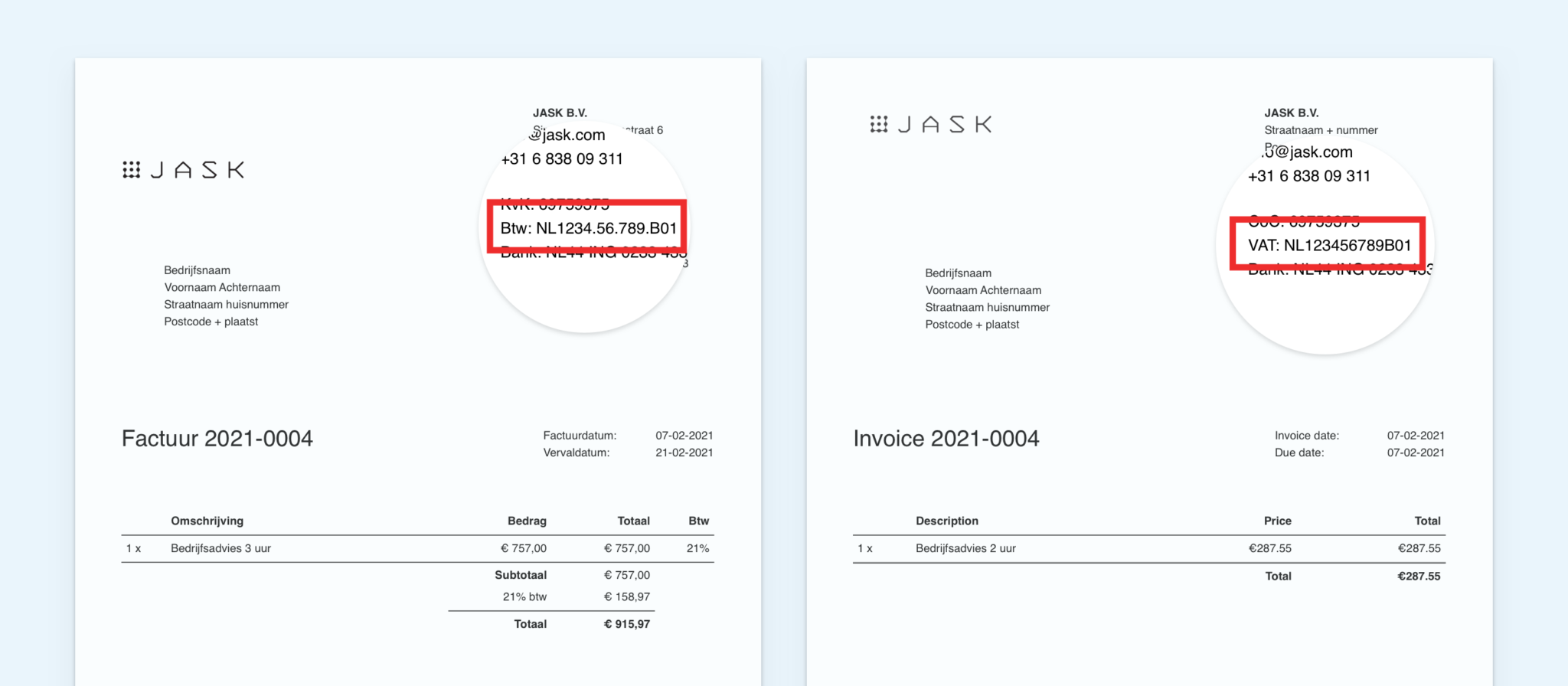

VAT nummer Wat is dat? Voorbeelden Gouden Tips » DeSoftware

What is a Company's VAT Number? A VAT (Value Added Tax) number in the UK is a unique identification number assigned to businesses that are registered to collect VAT. This number is used by HM Revenue & Customs (HMRC) to track and monitor the VAT payments made by the business. In the UK, a VAT number is also known as a VAT registration number, and it usually consists of the prefix "GB" followed.

Blog Serwis Doradztwa Zagranicznego

Co to jest numer VAT? Numer rejestracyjny podatnika VAT jest kodem literowo-cyfrowym i składa się z maksymalnie 15 znaków. Pierwsze dwie litery to informacja o kraju członkowskim, np. symbol DE oznacza Niemcy. Wprowadzając swój numer podatnika VAT, należy koniecznie podać dwie litery umożliwiające zidentyfikowanie kraju.

VAT in UAE Value Added Tax in Dubai VAT SAB Auditing

This utility provides access to VIES VAT number validation service provided by the European commission. It also supports VAT checking for countries which are not part of the EU VAT Scheme such as Great Britain and Switzerland. Example: GB731331179 for Great Britain, CHE-193.843.357 for Switzerland, NO974761076 for Norway.

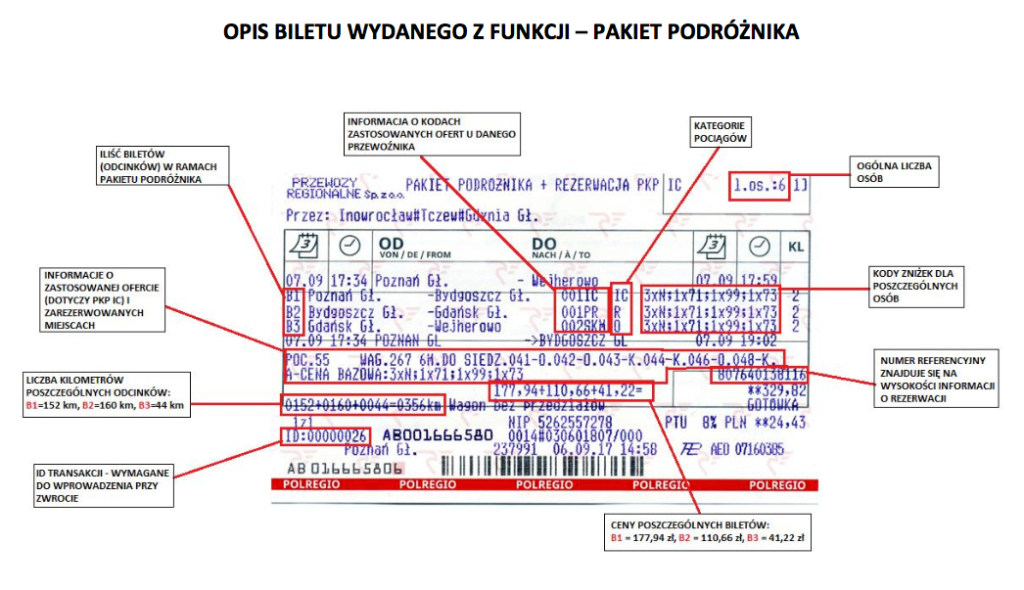

[Polska] Wspólny Bilet na kolei Page 6 SkyscraperCity Forum

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. VIES stands for VAT Information Exchange System, and is a VAT number lookup service provided by the.

Logowanie Portal Klienta 21168 Hot Sex Picture

1. Look at an invoice or insurance document to find a VAT number. If a company uses VAT taxes in their prices, they'll usually list the company's VAT number somewhere on the document. Check for VAT numbers near the letterhead on top of the page or by the information at the bottom.

VAT Registration with SARS l Apply Online Now l Fast and Easy

Jeśli w VIES nie możesz znaleźć odpowiednich informacji, powinieneś zwrócić się o nie do krajowych organów administracji. Następnie powinieneś być w stanie uzyskać potwierdzenie o tym: czy numer VAT jest ważny, czy też nie jest. czy numer VAT jest powiązany z jakąś nazwą i adresem. Z krajowymi organami administracji można.

Numer VAT UE kontrahenta na fakturze eGospodarka.pl Porady podatkowe

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool. The search result that is displayed within the VIES tool can be in one of two ways; EU VAT information exists ( valid) or it doesn't exist.

Jak sprawdzić numer VAT w systemie VIES? Infor.pl

There are standardised rules on VAT at EU level. But these can be applied in different ways by EU countries. Special rules on VAT apply if you buy or sell goods or services from or to another EU country. Refunds may be possible if your business is charged VAT on activities in another country. Find EU policy, current and upcoming law, and other.

VAT UE europejski numer VAT co trzeba wiedzieć?

Z tego tekstu dowiesz się: VAT UE to potoczna nazwa europejskiego numeru NIP. Musi go posiadać każdy podatnik VAT, który jest stroną w wewnątrzwspólnotowych transakcjach handlowych. Sprawdź, w jakich sytuacjach musisz posługiwać się numerem VAT UE, w jaki sposób o niego zawnioskować i jakich obowiązków trzeba będzie dopełnić.